A complete guide to IR35 for recruitment agencies

In the recruitment landscape, staying well-versed in the legal intricacies that impact your agency is important. One such critical element that demands your attention is IR35. Whether you're a recruitment agency startup looking to understand what IR35 changes mean for recruitment agencies or a seasoned professional in a larger agency looking for more efficiencies and opportunities in this area, you've landed in the right place.

In this comprehensive guide, we'll support you through all the complexities of IR35 for recruiters – its meaning, changes, and legislative implications – and help you navigate this complex terrain with confidence.

This guide to IR35 covers all the details on how IR35 impacts your recruitment agency business.

Inside or outside IR35 – what’s better for contractors?

Whose responsibility is IR35 determination?

How can you tell if a contractor is 'inside' or 'outside' IR35?

How does IR35 affect recruitment agencies?

What are the IR35 opportunities for recruitment agencies?

IR35 meaning

What is IR35, you may be asking? First established in 1991, IR35 was intended to tackle the issue of tax avoidance by employees working as contractors. The legislation was put in place to ensure that employees working through an intermediary, such as recruitment agencies or any type of organisation that arranges for people to work for another business and be paid for the work done. However, this meant that such workers would be expected to pay around 25% more in taxes annually.

Although the IR35 legislation has existed for almost two decades, it was largely ineffective and highly criticised for its inept conception and implementation. Previously, contractors (or off-payroll workers) held the power to decide whether their contract fell inside or outside the legislation. In April 2021, significant reforms to the IR35 legislation shifted the responsibility from the contractor to the end client they are working for.

End clients that are medium to large businesses are responsible for determining the IR35 compliance of their contractors and are expected to justify their decision in a Status Determination Statement. However, small businesses are exempt from the reform, leaving contractors engaged by them to make the decision.

Why is IR35 important?

IR35 holds significant importance for both contractors and end clients, shaping the landscape of freelance work and its tax implications. For contractors, understanding IR35 determines whether they are classified as "inside IR35" or "outside IR35," which profoundly impacts their tax status.

Being categorised as "inside IR35" means they are essentially treated as employees for tax purposes, subject to higher tax and National Insurance contributions. On the other hand, being "outside IR35" grants them more tax efficiency and flexibility in managing their finances.

For end clients, the implementation of IR35 regulations signifies increased responsibility in determining the employment status of contractors they engage with. Accurately assessing whether a contractor falls within IR35 parameters is crucial, as misclassification could lead to legal and financial consequences.

Compliance with IR35 not only affects taxation but also has broader implications for workforce planning, budgeting, and overall business operations. So, grasping the nuances of IR35 is indispensable for contractors and end clients alike, ensuring fair tax practices, legal compliance, and a smooth functioning of the freelance economy.

Inside or outside IR35 – what’s better for contractors?

Below is a table listing the pros and cons for being in or outside IR35 for contractors:

| Inside IR35 Pros | Inside IR35 Cons | Outside IR35 Pros | Outside IR35 Cons | |

| Tax & NI | Simpler tax calculations | Potentially higher tax and NI payments | Potential for greater tax efficiency | Responsibility for accurate tax assessments |

| Employee Benefits | Eligibility for some employment benefits | Limited access to contractor benefits | Flexibility in benefit selection | No access to traditional benefits |

| Project Control | Clearer guidelines from clients | Less control over project decisions | More autonomy over project choices | Responsibility for project management |

| Liabilities | Reduced personal liability for projects | Potential for disputes over employment | More protection from legal issues | Need to manage liability independently |

| Flexibility | Stable income during downtime | Less control over income | Potential for higher earning | Income uncertainty between contracts |

Of course, the impact of IR35 can vary depending on individual circumstances, the specific contract, and financial goals. It’s clear that being outside IR35 offers up significant opportunities for tax breaks, but contractors need to manage their own tax payments.

If the drawbacks of being an independent contractor outside IR35 are too high, there is always the possibility of working under an umbrella company for less administrative hassle. 3R only work with Umbrellas who are approved by the FCSA or Professional Passport, we have over 150 on our preferred supplier list.

Whose responsibility is IR35 determination?

Whose responsibility is IR35 determination?

The responsibility for determining IR35 status rests on the shoulders of the end client in most cases. As per the changes introduced in IR35 legislation, since April 2021 in the private sector (previously applicable only to the public sector), the job of assessing whether a contractor's engagement falls inside or outside IR35 lies with the organisation that engages their services. This shift transfers the obligation from the contractor to the end client.

End clients must conduct a thorough assessment of each contractor's working arrangement to determine if they should be considered an employee for tax purposes (inside IR35) or if they operate as a genuine independent business (outside IR35). This determination involves evaluating factors such as control, substitution, mutuality of obligation, and more.

Accurate IR35 determination is vital, as it affects tax liabilities, compliance, and potential legal ramifications. By assuming this responsibility, end clients play a pivotal role in maintaining fairness, transparency, and compliance within the contractual work relationships under the IR35 framework.

HMRC offers an online Tax Status Determination tool to help determine if the IR35 off-payroll working rules apply to a contract, or if some work is classed as employment or self-employment for tax purposes.

How can you tell if a contractor is 'inside' or 'outside' IR35?

What does it mean to be inside or outside of the reformed IR35 regulation?

Inside: When a contractor is classed as being inside IR35, there are two options: either to be considered as an employee of the end client (PAYE), or to be processed through an umbrella company, in effect employed by the umbrella company, where they are responsible for ensuring that the contractor is payrolled compliantly and for making all the relevant deductions at source.

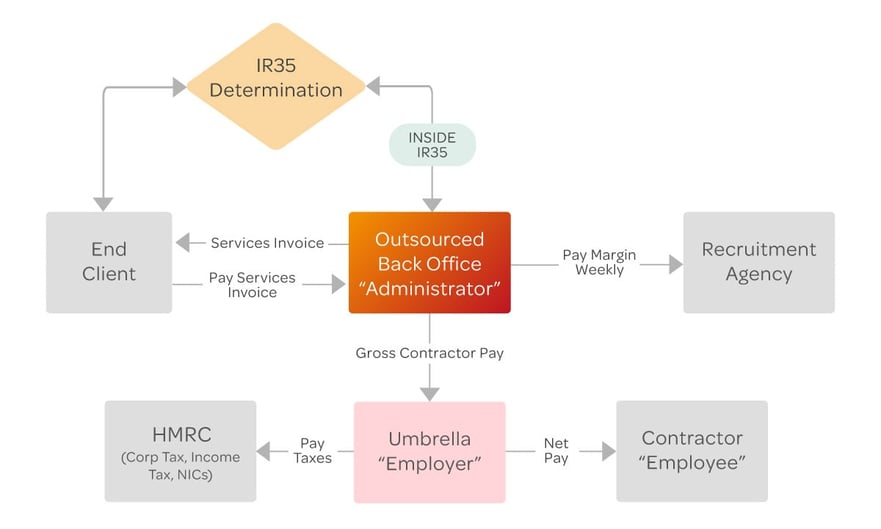

From a recruitment perspective, when operating with an outsourced funding and Back Office solution, here's what the client invoice, contractor payroll, and recruiter margin flows would look like:

However, a word of caution – not all umbrella companies are the same, and several stories have emerged about unethical practices related to umbrella companies. 3R have a carefully vetted preferred supplier list for umbrellas, and we always do due diligence to check they are above board for you as a recruitment agency.

However, a word of caution – not all umbrella companies are the same, and several stories have emerged about unethical practices related to umbrella companies. 3R have a carefully vetted preferred supplier list for umbrellas, and we always do due diligence to check they are above board for you as a recruitment agency.

Outside: To be classed as being outside IR35 means that for tax purposes, HMRC will consider a contractor as self-employed and eligible for the tax benefits associated with self-employment. The end client must produce a Status Determination Statement to clarify their justification of the contractor’s IR35 status.

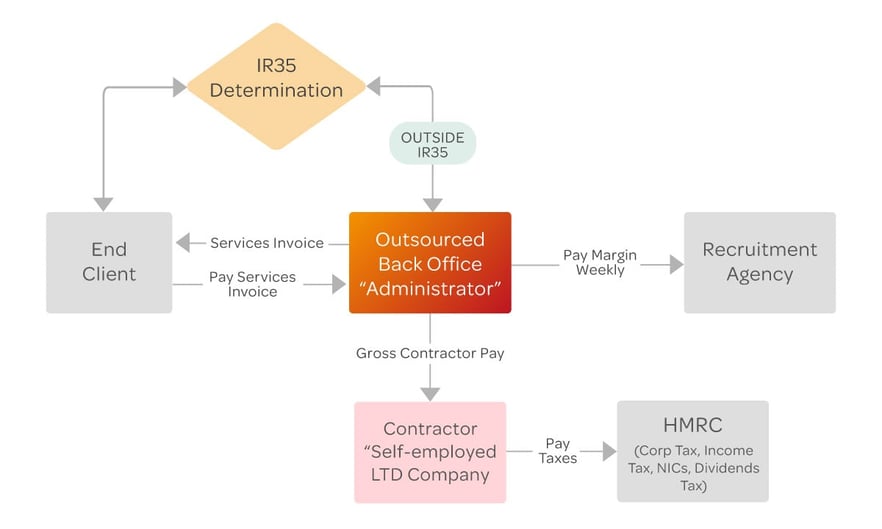

Here's what the outside IR35 cash flow would look like:

Here is a selection of top-level rules that determine whether a contractor is “inside” or “outside” IR35:

| Inside IR35 | Outside IR35 |

| The end client is in control of how, when and where the contractor carries out their work. | The contractor is responsible for delivering the work agreed and thus is in control of how they carry out their work. |

| If the contractor is not available, a substitute will not be accepted to carry out the work on their behalf. | A substitute can be used to carry out the work on the contractor’s behalf if the contractor is not available. |

| The contractor is paid at regular intervals regardless of the status or quality of the work. The employer is regarded as being responsible for deducting their taxes and NICs. | Contractor receives payments based on invoices submitted after deliverables have been received. They are responsible for their own taxes and NICs. |

| The contractor gets the same access to systems, equipment and on-site benefits as employees. | The contractor is treated as an external resource without the same access to benefits and equipment as employees. |

How does IR35 affect recruitment agencies?

How does IR35 affect recruitment agencies?

Recruiters occupy a crucial intermediary position when it comes to IR35 compliance, acting as a bridge between contractors and end clients. While the ultimate responsibility for IR35 determination lies with the end client, recruiters play an instrumental role in facilitating this process. They need to collaborate closely with both parties to ensure accurate and compliant assessments.

Recruiters are often tasked with providing detailed information about the contractor's role, working conditions, and engagement terms to the end client. Clear communication is essential to ensure that all parties have a comprehensive understanding of the assignment. Recruiters also need to be well-versed in IR35 regulations themselves, as they serve as an informed resource for contractors and clients, addressing queries and concerns related to the legislation.

Recruiters are also instrumental in assisting with the transition and adaptation to any changes in IR35 legislation. Their guidance can help contractors and clients navigate the complexities of the regulations, fostering transparency, compliance, and fairness in the freelance ecosystem.

So, what should you do as a recruiter to ensure compliance with IR35 regulations?

- Ensure that contracts and terms of business are clear regarding tax legalities and accountability

- Ensure that each assignment has been treated with reasonable care and facilitate IR35 status determination accurately as part of your day-to-day practices

- Keep documented proof of IR35 Status Determination decisions for the legally specified period

- If a contractor is deemed to be inside IR35 and not paid via an umbrella, the recruiter becomes responsible for making PAYE payments to HMRC before paying the net amount to the limited company of the contractor

- HMRC requires recruitment agencies to submit regular information, known as ‘Intermediary Reporting’ to help them easily identify people who have not declared their earnings. Read more about intermediary reporting here.

What are the IR35 opportunities for recruitment agencies?

Recruitment agencies can leverage IR35 regulations strategically to offer value-added services, enhance client relationships, and ensure compliance.

- Agencies can position themselves as experts in IR35 by staying updated with the latest changes and providing up-to-date information to both contractors and clients. This positions them as trusted advisors and builds client loyalty.

- Agencies can offer assistance with IR35 assessments, helping end clients accurately determine a contractor's status. This service streamlines the compliance process and showcases the agency's commitment to supporting their clients' legal obligations.

- Agencies can help contractors to understand IR35 regulations and guide them on optimising their tax situation. By offering workshops, resources, or partnering with tax experts, agencies can empower contractors to make informed decisions, boosting their satisfaction and loyalty.

- Recruitment agencies can facilitate smoother transitions during changes in IR35 legislation by providing guidance on adapting contracts and engagement models. By proactively embracing IR35, recruiters can elevate their standing in the industry and strengthen their role as invaluable partners to both contractors and clients.

By partnering with a reputable back office platform provider, IR35 requirements become much easier to manage, and by supporting the usage of umbrella companies for contractors you can help solve problems when contractors are determined to be inside IR35.

What can 3R do to help?

Our robust contractor onboarding ensures recruiters can comply with IR35 requirements confidently. As part of our automated system, recruiters and clients can now collaborate on IR35 determination easily and quickly. Here is how 3R can help you with IR35 compliance:

- 3R’s Back Office system has a simple IR35 determination process flow that allows the recruiter to initially decide whether a contractor is “inside” or “outside”

- If “outside”, then an automated email will be sent to the end client asking them to confirm the contractor's IR35 determination, allowing the end client to upload status determination statements as necessary

- If “inside”, the contractor will be presented with options to be processed as inside IR35, such as using a compliant umbrella company

- ‘Statement of Work’ agreements are available that outline the services, requirements, and responsibilities being provided by the contractor. This document type can put end-clients in a better position to judge and justify a contractor’s IR35 status to be ‘outside IR35’

- We have a simple green, amber and red traffic light system to help recruiters easily monitor and review the onboarding status of contractors and in the IR35 Compliance Register all activity and history can be easily identified when needed by HMRC

- Regarding your Intermediary Reporting duty, our system reminds you every quarter to simply download your report – already formatted exactly as the HMRC requires it. So, all you have to do is log into your Government Gateway Account and upload the file – easy and quick

As with any significant legislation, we are still likely to see evolving reactions in the form of new processes, documentation, and systems that seek to resolve the complications of compliance. At 3R we continue to adapt to any changes in legislation keeping our technology, not only up to date, but offering the most cutting-edge systems that help recruiters to place contractors more easily.

Last updated: September 2024